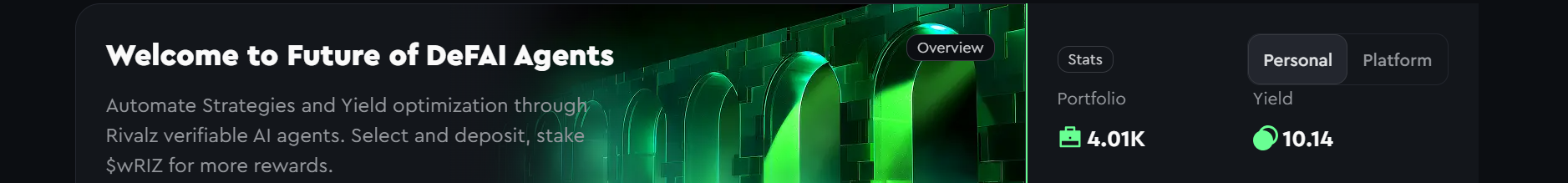

MOZAI is Live: Yield Automated by Agents

After a successful private access phase, MOZAI is now open to the public!

MOZAI is a non-custodial intelligent yield engine on Base. Deposit stablecoins, and MOZAI Agents automatically route your funds across integrated protocols to optimize risk-adjusted yield 24/7, no APY chasing, no constant strategy management required.

It’s DeFi with a brain.

Behind the scenes, MOZAI is powered by the ADCS oracle layer, with agent decisions executed and immutably recorded on the Rivalz Chain, backed by the zNode infrastructure.

Therefore, every move the agents make is transparent and on-chain.

Security: Non-Custodial, Smart-Account Based

MOZAI is built as a non-custodial system, not a giant staking pool controlled by a team multisig. Instead, each MOZAI agent operates through its own smart wallet (smart account), governed entirely by on-chain agent logic. There’s no private key, no off-chain signer, and no way for an external party to “take over” your funds.

On top of that, every agent is constrained by a strict allowlist of approved contracts and functions. It only “knows” the specific lending markets and vaults it’s permitted to use, and its smart wallet can interact only with those pre-approved contracts. This means:

- The agent can move funds only between supported protocols and vaults.

- It cannot send assets to arbitrary addresses or random contracts.

- Even if someone tries to induce the agent into doing something else, the smart wallet doesn’t have permission to execute those actions.

MOZAI can’t remove the inherent risks of the underlying DeFi protocols, but its smart-account architecture is designed to ensure that agent intelligence doesn’t become a new attack vector.

Current USDC Vaults and Markets

At launch, MOZAI agents optimise across a curated set of $USDC yield opportunities on Base.

Morpho vaults:

- Spark USDC

- Steakhouse USDC

- Moonwell Flagship USDC

- Seamless USDC

- Gauntlet USDC Prime

- Gauntlet USDC Core

- Pangolins USDC

- Re7 USDC

Lending markets:

- Fluid – Lending USDC

- Compound – Base Lending USDC

- Aave – Lending USDC

MOZAI’s agents constantly monitor yields and risk across these markets, reallocating when there is a sufficient improvement in risk-adjusted return.

How MOZAI Rewards Work

MOZAI uses a dual-rewards model: you earn $USDC yield from DeFi, plus additional upside in $wRIZ from the Rivalz ecosystem.

1. Base Yield – Earn in $USDC

When you deposit into a MOZAI Agent:

- Your USDC is deployed into a curated set of yield sources on Base.

- The agent tracks yields and risk in real time and reallocates when it makes sense.

- Your Portfolio value in MOZAI grows over time in $USDC.

This is your core, protocol-driven yield.

2. Boosted Yield – Earn Extra in $wRIZ

Beyond the base $USDC yield, users can unlock APY boosts paid in $wRIZ by staking $wRIZ and moving up through tiered levels:

These boosts are distributed in $wRIZ, not stables:

- $wRIZ rewards → accumulate separately as 'Claimable $wRIZ'.

- You can claim your $wRIZ at any time directly from MOZAI.

A Head Start for zNode Holders

zNode holders don’t start from zero. They are automatically placed in Tier 3, unlocking a +3% APY boost in $wRIZ from day one on MOZAI.

The Buyback Program

Beyond yield, MOZAI also introduces a buyback-driven mechanism for $RIZ.

30% of MOZAI protocol revenue is directed into a $RIZ buyback program.

Over time, this means:

More MOZAI usage and TVL → More fees captured → More $RIZ buybacks and ecosystem rewards.

Every deposit doesn’t just benefit the user, it also helps power the wider Rivalz economy.

MOZAI is just getting started

In 2026, MOZAI evolves from a yield engine into a full DeFAI brain for your capital, adding:

- AI-powered LP management

- BTC and ETH yield

- MOZAI Trading

- MOZAI Perps

Today, MOZAI optimises your stables.

Tomorrow, it runs your entire on-chain strategy.

If you want to learn more, explore the Rivalz official documentation.

Join our Discord — the team and the community are there to help you get set up with MOZAI and the future of DeFAI.