Rivalz Pulse #3 - MOZAI in Motion

Welcome back to Rivalz Pulse, your go-to recap to stay on top of everything happening across the Rivalz ecosystem.

MOZAI went live in December as a non-custodial, agent-powered yield engine on Base.

Since then, it has quietly evolved from a single USDC agent into a small but serious line-up of agents across multiple networks and the app itself has been getting sharper, more transparent and easier to read.

This Pulse is all about where MOZAI stands today, what changed in the app and where we’re taking it next.

From One Agent to Five

When we published the last article, MOZAI only had one agent live:

a USDC agent on Base, routing stablecoins across curated vaults and lending markets.

Today, MOZAI runs five agents across three networks:

- USDC Core Yield | Base

The original core agent. Routes USDC across selected vaults and lending markets on Base, optimising for risk-adjusted yield. - ETH Core Yield | Base

An ETH-focused agent on Base, extending MOZAI beyond stablecoins. Same philosophy, different asset: agent logic handling yield strategies for ETH. - USDC Max Yield | Avalanche

Our first step outside Base. This agent brings MOZAI’s automated yield logic to Avalanche, giving users a way to put USDC to work in that ecosystem. - USDT Max Yield | HyperEVM

A USDT-focused agent deployed on HyperEVM, designed for users who want to put capital to work in this emerging ecosystem through non-custodial, agent-driven yield optimisation. - USDC Max Yield | HyperEVM

Extending MOZAI’s non-custodial yield logic to another core stablecoin within this fast-growing environment.

Here is an overview of all current agents and their underlying vaults/markets:

Small Updates for Better Clarity in the App

Alongside new agents, MOZAI also shipped a few important quality-of-life upgrades inside the app.

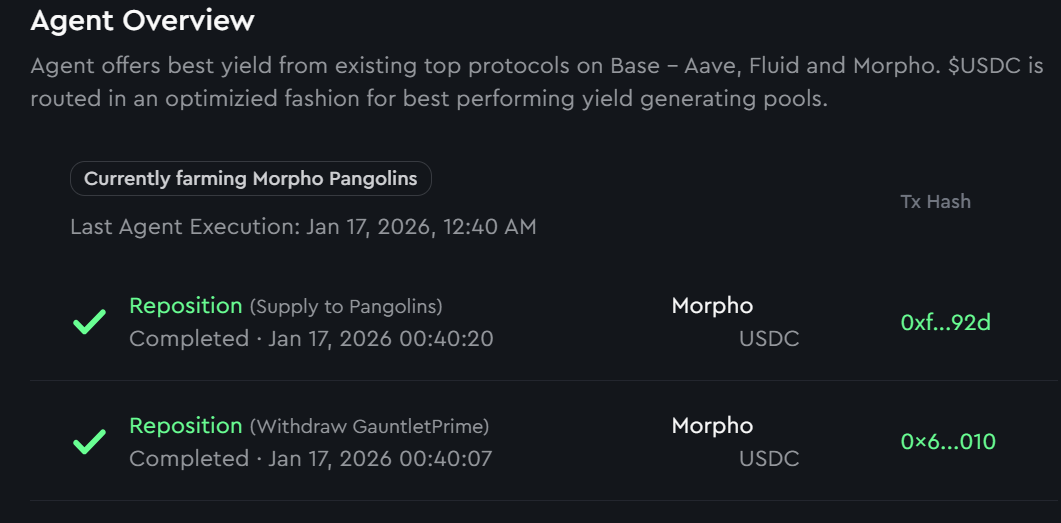

1. Transaction History: See Exactly What Agents Are Doing

You can now see, in the History section, exactly:

- Which vaults or markets your funds are withdrawn from.

- Where the agents are depositing next.

This makes every rebalance and every move traceable:

- No “black box” behaviour.

- Clear inflows and outflows between integrated protocols.

- Better understanding of how agent logic reacts over time.

If MOZAI moves your capital, you can see from which vault it left and where it landed.

It’s a simple change on the surface, but a big step for transparency.

2. Network-Aware Tags for Agents

Tags inside the app now clearly show which network each agent operates on.

This may look like a small detail, but it matters when MOZAI becomes more multi-chain.

As more agents and chains arrive, these network-aware tags become the visual language that keeps MOZAI understandable at a glance:

- You instantly know if an agent is on Base, Avalanche or HyperEVM.

- It reduces confusion when switching between agents.

- It makes it easier to match your own network preferences.

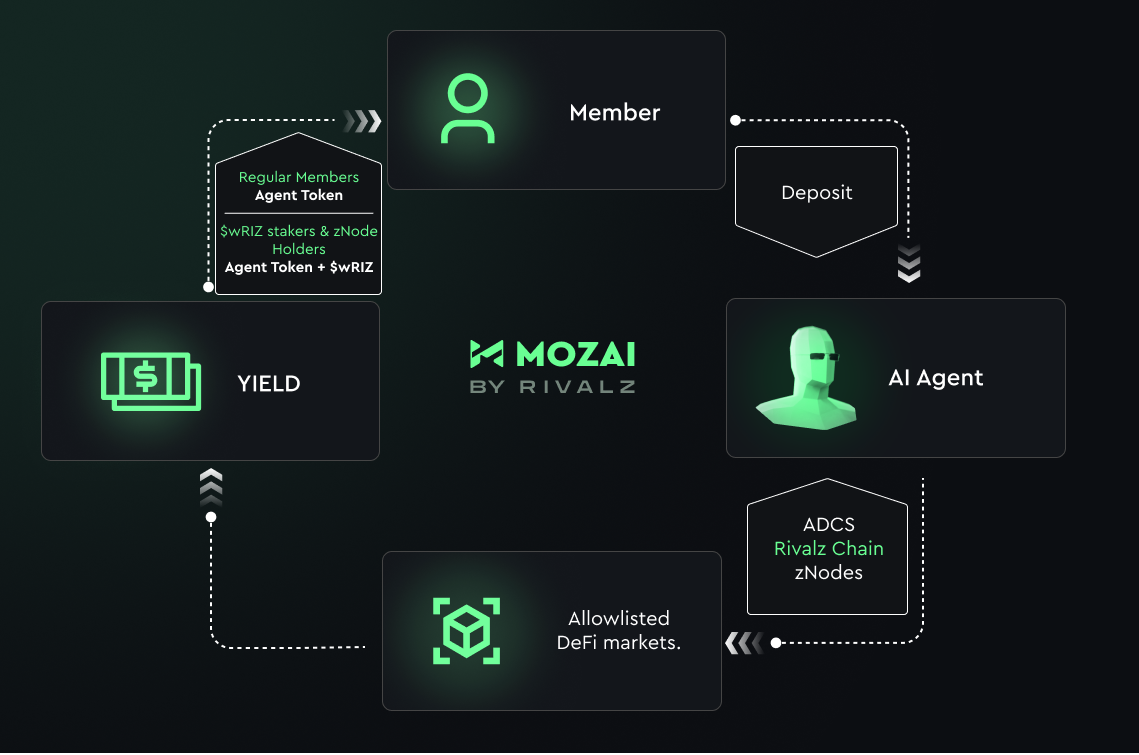

Under the Hood: Same Principles and a Broader Surface

Even as MOZAI expands across more assets and networks, the core principles remain the same:

- Non-custodial, smart-account based architecture.

- ADCS providing the oracle layer for agent decisions.

- Execution and state recorded on the Rivalz Chain, with zNodes supporting the infrastructure.

More agents and more networks do not mean more trust assumptions.

The goal is to scale the surface of where agents can operate, without compromising on how they operate.

At the incentive layer, the ecosystem remains tightly aligned:

zNode holders automatically receive a +3% APY boost in $wRIZ, while $wRIZ stakers can unlock up to +6% APY through tiered boosts.

As MOZAI expands across chains and assets, this alignment grows with it. More activity, more yield and stronger integration between users, agents and the Rivalz economy.

What Comes Next for MOZAI

First, we keep pushing on:

- Bringing more agents to more networks, so users can choose the ecosystems and assets they care about, while keeping the same agent-native, non-custodial experience.

- Expanding the catalogue of strategies while staying disciplined about risk and protocol selection.

Second, we are working on a special agent that we’ve been building quietly in the background.

It’s an agent designed to showcase what MOZAI can really do when we go deeper into agent-native finance.

More on that soon.

Finally, once the current wave of new agents is live, we’ll turn our attention to improving the deposit experience:

- Making it easier to scale your portfolio across agents.

- Smoother flows for adding capital.

The goal is simple: if agents are going to run yield for you, growing your position should feel as easy as trusting the system.

If you want to go deeper into how MOZAI works, the rewards and buyback model behind it:

As always, the community and team are on Discord if you have questions.